KYC Documents for Canara Bank: KYC (Know Your Customer) is a critical process that all banks and financial institutions follow to verify the identity of their customers. For Canara Bank, one of India’s leading public sector banks, completing the KYC process is essential for availing of a wide range of banking services. In this article, we will walk you through the necessary KYC documents required by Canara Bank, the process, and other important details you need to know.

What is KYC and Why is it Important?

KYC is a process used by banks and financial institutions to verify the identity of their customers. The primary purpose of KYC is to prevent illegal activities such as money laundering, fraud, and terrorism financing. For customers, completing KYC ensures that their accounts are legally compliant and helps to protect their financial assets.

Canara Bank, like other banks in India, requires its customers to submit KYC documents when opening a new account, making changes to existing accounts, or availing of specific services. Completing the KYC process also ensures that the bank complies with regulatory requirements.

Types of KYC Documents for Canara Bank

Canara Bank accepts various documents as part of the KYC process. These documents are broadly divided into two categories: Identity Proof and Address Proof. Let’s break them down:

1. Identity Proof Documents

The identity proof documents are required to verify your name and confirm your identity. Some of the commonly accepted identity proofs for KYC in Canara Bank are:

| Document Type | Accepted Documents |

|---|---|

| Passport | Valid passport |

| Aadhaar Card | Aadhaar card issued by UIDAI |

| Voter ID | Election Commission’s Voter ID card |

| Driving License | Valid driving license issued by the concerned authority |

| PAN Card | Permanent Account Number card |

| NREGA Card | Job card under the National Rural Employment Guarantee Act |

These documents are used to verify the customer’s identity, ensuring that the person applying for an account or service is who they say they are.

2. Address Proof Documents

To verify the customer’s residential address, Canara Bank accepts various address proof documents. Here are some of the commonly accepted address proofs:

| Document Type | Accepted Documents |

|---|---|

| Utility Bills | Electricity bill, water bill, telephone bill (not older than 3 months) |

| Bank Statement | Statement of account or passbook from another bank |

| Aadhaar Card | Aadhaar card (shows both identity and address) |

| Voter ID | Election Commission’s Voter ID card (shows address) |

| Ration Card | Government-issued ration card |

| Lease Agreement | Signed rental/lease agreement |

These documents help Canara Bank confirm your current residential address. It’s important to ensure that the documents you submit are recent, as old address proofs may not be accepted.

read also: How to Open an SBI Bank Account: Complete Guide 2024

KYC Process at Canara Bank

The process of completing your KYC for Canara Bank is relatively straightforward. Here’s what you need to do:

Step 1: Visit the Nearest Canara Bank Branch

You can start the KYC process by visiting the nearest Canara Bank branch. Carry all the necessary original documents, as well as photocopies of the documents to be submitted for verification.

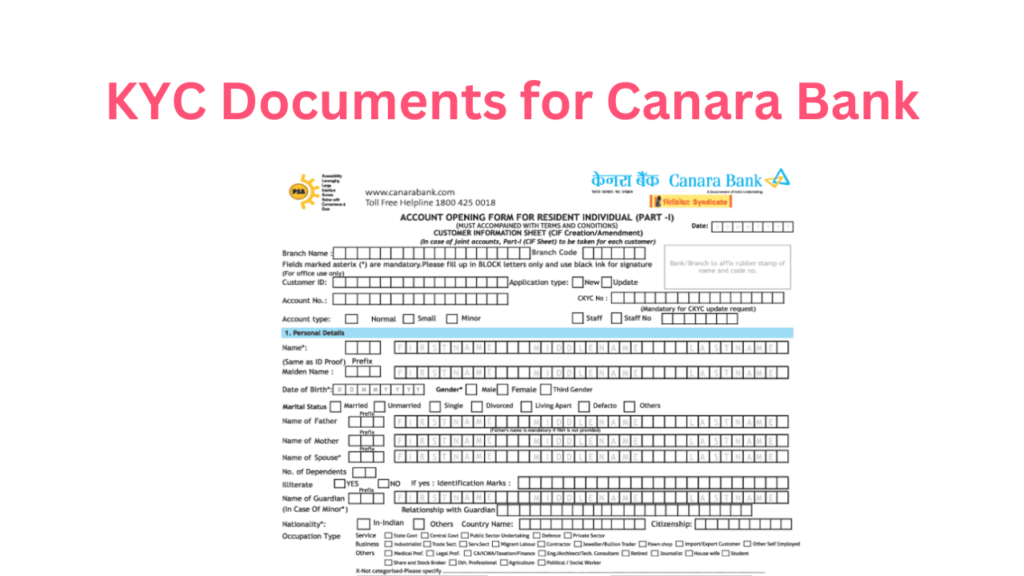

Step 2: Fill the KYC Form

Once at the branch, you will be asked to fill out the KYC form. This form will require basic information like your name, date of birth, address, and contact details. Ensure that you provide accurate information to avoid any issues during the verification process.

Step 3: Submit Documents for Verification

Submit the original documents for verification. The bank officials will cross-check the documents and return the originals to you. The copies will be kept for their records. If you are submitting Aadhaar as a proof of address, you may need to give your Aadhaar number.

Step 4: Biometric Verification (for Aadhaar-based KYC)

If you are using Aadhaar as your KYC document, you may be asked to provide biometric verification. This includes fingerprint and iris scanning to authenticate your identity. This step helps in reducing the risk of identity fraud.

Step 5: Receive Confirmation

Once your documents are verified and approved, you will receive a confirmation from the bank. Your account will be successfully KYC-compliant, and you will be able to enjoy all banking services.

KYC for Existing Customers

If you are an existing Canara Bank customer and your account is not KYC-compliant, you may be asked to complete the KYC process at any time. The bank may send you notifications asking you to update your KYC documents, especially if there are changes in regulatory guidelines or if your existing documents have expired.

To complete the KYC update for an existing account, follow the same procedure as a new customer. Visit the nearest branch with the necessary documents and fill out the KYC update form.

KYC for Non-Residents and NRIs

Non-resident Indians (NRIs) and persons of Indian origin living abroad are also required to complete KYC while opening an account with Canara Bank. NRIs can submit the following documents:

| Document Type | Accepted Documents |

|---|---|

| Valid Passport | Passport (valid for at least 6 months) |

| Address Proof (Overseas) | Utility bill, bank statement, or lease agreement |

| Recent Photograph | Passport-size photograph |

For NRIs, Canara Bank also offers the option to complete the KYC process online through their website or mobile banking app.

Common KYC Issues and How to Avoid Them

While submitting your KYC documents, you may encounter a few issues. Here are some common problems and how to avoid them:

1. Incorrect or Incomplete Documents

Ensure that the documents you provide are accurate and not expired. For example, utility bills should not be older than three months, and Aadhaar cards should be valid.

2. Mismatch in Information

Double-check that the information you provide on the KYC form matches exactly with the details on the submitted documents. Any mismatch in names, addresses, or dates of birth may cause delays in the verification process.

3. Failed Biometric Verification

If you’re completing Aadhaar-based KYC, make sure your biometrics are up to date. In case of a mismatch, you may need to visit an Aadhaar enrollment center for biometric re-verification.

Conclusion

Completing the KYC process is essential for availing of Canara Bank’s services and ensuring compliance with Indian regulations. By providing the necessary documents such as identity and address proofs, and following the prescribed steps, you can easily complete your KYC process. If you’re unsure about the documents required or the process itself, don’t hesitate to ask the bank officials for guidance. Completing KYC ensures that your financial transactions are safe and secure, protecting both you and the bank.

read also: Kotak Bank Zero Balance Account 2024 – Know Everything