How to Open an SBI Bank Account: Opening a bank account is an essential step in managing your finances, and State Bank of India (SBI), one of the largest public sector banks in India, offers a range of services to cater to your needs. Whether you are opening an account for the first time or switching banks, this guide will walk you through the process of opening an SBI bank account. We’ll also explore the benefits, types of accounts available, and the required documents.

Types of SBI Accounts You Can Open

SBI offers various types of accounts to meet the diverse needs of its customers. Before proceeding with the account opening process, it is important to understand the different types of accounts you can open:

1. Savings Account

A savings account is a basic type of account suitable for individuals looking to save money while earning interest. It allows easy access to funds, and you can also earn interest on your savings balance.

2. Current Account

A current account is primarily used by businesses for day-to-day transactions. It doesn’t offer much in terms of interest but allows for unlimited deposits and withdrawals.

3. Fixed Deposit Account

A fixed deposit account is ideal for individuals who want to park their savings for a fixed tenure. It offers higher interest rates compared to a savings account.

4. Recurring Deposit Account

This account allows customers to deposit a fixed amount regularly for a specific period, earning interest on the deposits.

5. Joint Account

SBI also offers joint accounts, where two or more individuals can jointly manage the account. This is ideal for families or business partners.

Documents Required to Open an SBI Bank Account

To open an SBI bank account, you will need to provide certain documents to verify your identity and address. The documents may vary depending on the type of account and the applicant’s status (resident, NRI, minor, etc.).

Here is a list of commonly required documents:

| Document Type | Acceptable Proofs |

|---|---|

| Proof of Identity | Passport, Aadhar card, Voter ID, PAN card, Driving license |

| Proof of Address | Aadhar card, utility bills (electricity, water), bank statements |

| Photographs | Passport-size photographs (usually 2-3) |

| PAN Card | Required for individuals who want to open a savings or current account |

| Income Proof | Required for certain account types (e.g., for loans or fixed deposits) |

How to Open an SBI Bank Account

Opening an SBI account is a straightforward process that can be done either online or offline. Let’s break down the steps involved:

Step 1: Choose the Type of Account

Before opening an account, decide on the type of account that suits your requirements. SBI offers different accounts based on your needs, so choose one that best fits your financial goals.

Step 2: Visit the SBI Branch or Online Portal

You can either visit your nearest SBI branch to open the account or open it online through SBI’s official website or mobile banking app.

1. Offline (Branch Visit)

- Go to your nearest SBI branch with the required documents.

- Request an account opening form from the bank.

- Fill out the form with accurate personal details.

- Submit the form along with the necessary documents (identity proof, address proof, photograph).

- The bank representative will verify the documents and process your request.

2. Online (SBI Online Portal or YONO App)

- Visit the official SBI website or download the YONO app.

- Select “Open an Account” and choose the account type.

- Fill out the online form with your personal details.

- Upload the scanned copies of your documents (Aadhar card, PAN, photograph).

- Complete the video KYC process (if applicable).

- After verification, the bank will send you the account details.

Step 3: Complete KYC (Know Your Customer) Process

KYC is an important part of the account opening process, as it ensures that the bank complies with anti-money laundering regulations. This process can be completed either in person at the branch or online (through the YONO app).

1. In-person KYC:

The bank officer will verify your original documents and take a photograph.

2. Online KYC:

For online KYC, you will need to upload scanned copies of your documents. In some cases, a video KYC process will be conducted, where you will be asked to show your original documents through a video call.

Step 4: Deposit Minimum Balance

Some types of accounts, like a savings or current account, may require a minimum deposit to activate the account. Ensure that you deposit the required amount, which can vary based on the account type.

Benefits of Opening an SBI Bank Account

- Opening an SBI account comes with a range of benefits that make it one of the most trusted banks in India. Here are some of the key advantages:

- With thousands of branches and ATMs across India, SBI offers convenient access to your account, no matter where you are.

- SBI provides a user-friendly mobile banking app (YONO), allowing you to manage your finances, pay bills, and transfer money at your convenience.

- SBI offers competitive interest rates on savings accounts and fixed deposits, helping you earn more on your savings.

- SBI accounts come with enhanced security features, including two-factor authentication for online transactions, ensuring your money is safe.

- When you open a savings account, you are typically issued a free debit card, making transactions more convenient.

How to Check SBI Account Balance and Transaction History

Once your account is open, you can check your account balance and transaction history in the following ways:

1. SBI Internet Banking

- Log in to your internet banking account using your credentials.

- Check the account balance and transaction history under the “Account Summary” section.

2. SBI YONO App

- Open the YONO app on your phone.

- View your account balance and recent transactions directly from the app.

3. ATMs and SMS Banking

- You can also check your balance at any SBI ATM or through SMS banking.

Conclusion

Opening an SBI bank account is an easy and beneficial process. With its wide range of services, secure banking options, and convenient online banking features, SBI provides customers with everything they need to manage their finances effectively. By following the steps outlined above and providing the necessary documentation, you can quickly open an account and enjoy the benefits of banking with India’s largest public-sector bank.

read also: Kotak Bank Zero Balance Account 2024 – Know Everything

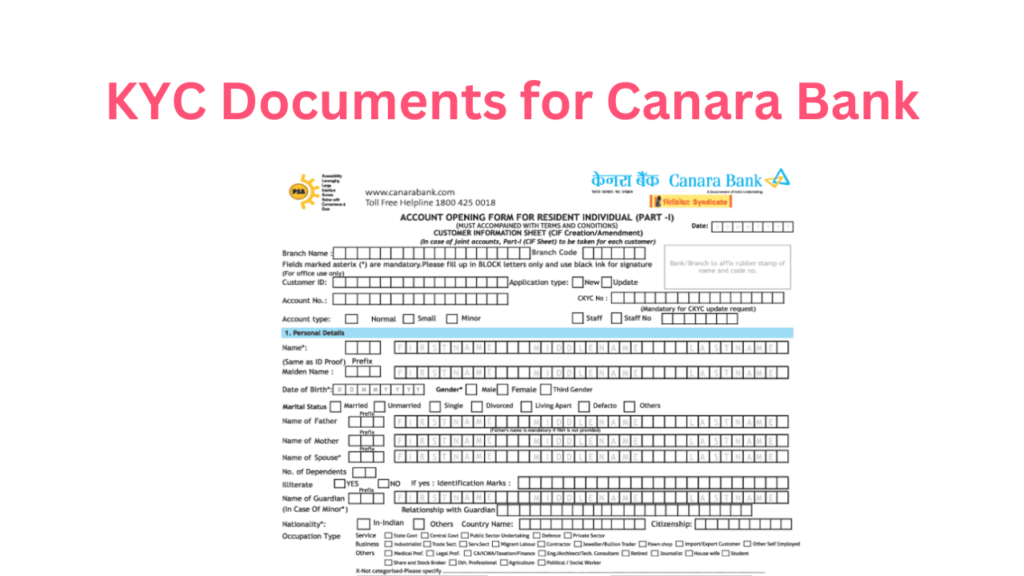

Pingback: KYC Documents for Canara Bank: Complete Information 2024 - US TRENDZ