Kotak Mahindra Bank is a prominent private sector bank in India. Over the years, it has gained a reputation for offering modern, customer-centric financial products. The zero balance account is one of its flagship offerings, making banking simple and accessible for everyone.

In a world where traditional accounts often come with maintenance charges and penalties for low balances, zero-balance accounts offer much-needed relief. They ensure financial inclusion, particularly for those with irregular or low incomes.

Features of Kotak Bank Zero Balance Account

- No Minimum Balance Requirement: You can maintain the account with a balance of ₹0, which is ideal for students, homemakers, and anyone with fluctuating finances.

- Free Digital Banking Services: With services like net banking, UPI, and mobile apps, managing finances becomes convenient and cost-effective.

- Debit Card Benefits: Account holders get a free debit card with added perks like cashback, discounts, and access to reward programs for online and offline shopping.

Eligibility for Opening a Zero Balance Account in 2024

- Age Criteria: Individuals aged 18 years and above can open the account. Minors can also open accounts, but they may require parental authorization.

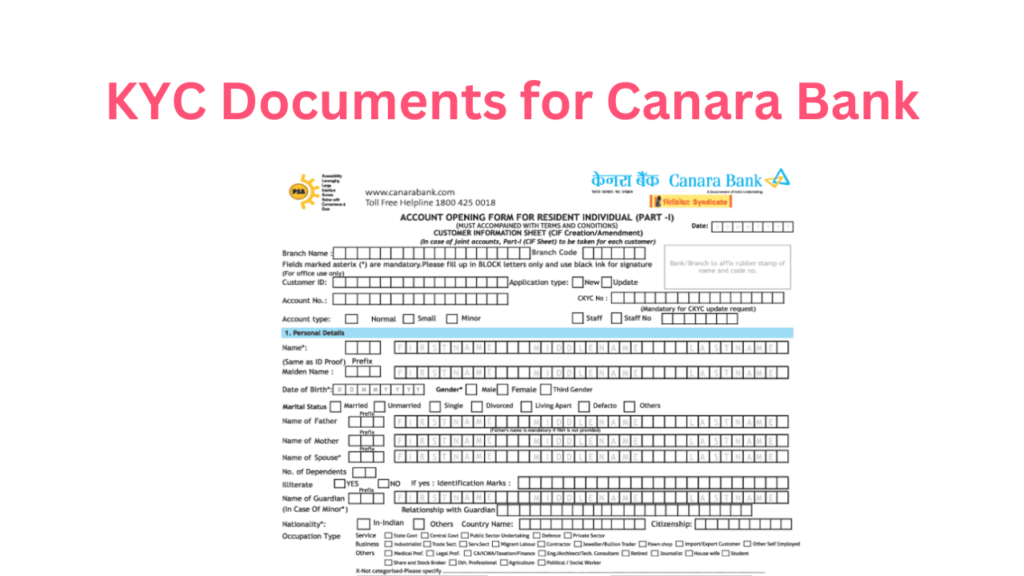

- Document Requirements: A streamlined process where customers need basic KYC documents such as:

- Aadhaar Card

- PAN Card

- Passport-sized photograph

- Proof of address (e.g., utility bill or rent agreement)

How to Open a Kotak Zero Balance Account

Online Process

- Visit the Kotak Mahindra Bank website or download the Kotak app.

- Select the “811 Zero Balance Account” option.

- Fill in personal details and upload scanned copies of the required documents.

- Complete e-KYC using Aadhaar-linked mobile OTP verification.

- Once verified, the account is instantly activated.

Offline Process

- Visit the nearest Kotak Mahindra Bank branch.

- Fill out the application form and submit physical copies of KYC documents.

- A bank official will guide you through the verification process.

Kotak Bank Zero Balance Account 2024 Fees and Charges

- Account Opening: Free (No charges for setting up the account).

- Maintenance Charges: None (No monthly or annual maintenance fees are applicable).

Debit Card Charges

- Physical Debit Card:

- Issuance Fee: ₹199 + GST (one-time).

- Annual Fee: ₹199 + GST (waived for certain promotional periods).

- Virtual Debit Card: Free (Available for online transactions).

Benefits of Kotak Zero Balance Account

- Cost-Effectiveness: Traditional savings accounts often come with hefty penalties for not maintaining a minimum balance. With Kotak’s zero-balance account, customers save on such charges.

- Ease of Use: The digital-first approach allows users to manage their accounts via mobile or desktop, ensuring smooth access to banking services.

- Accessibility: Kotak Bank’s extensive network of branches and ATMs ensures easy accessibility for customers in urban and rural areas alike.

Types of Zero Balance Accounts Offered by Kotak Bank

- 811 Digital Savings Account: This account is designed for tech-savvy individuals, offering a paperless and instant onboarding process.

- Basic Savings Account Under RBI Scheme: This account is aligned with the Reserve Bank of India’s directives to promote financial inclusion. It caters to customers needing basic banking facilities without incurring extra charges.

Kotak 811 Zero Balance Account Features

Customers can open and manage the account from the comfort of their home, using just a smartphone or computer. Kotak often offers competitive interest rates on savings, making it an attractive option compared to other banks.

Comparison with Competitor Zero Balance Accounts

- HDFC Bank: Offers a similar product, but its digital interface is not as intuitive as Kotak’s.

- SBI: Known for its large customer base, but processing times can be slow.

- Axis Bank: Provides additional services like cheque books but has higher maintenance charges on ancillary features.

Charges and Fees for Kotak Zero Balance Account

- Hidden Costs: While the account is marketed as free, charges may apply for premium services like SMS alerts, cheque books, or international transactions.

- Charges for Additional Services: For instance, issuing a demand draft or reissuing a lost debit card might involve nominal fees. Customers are advised to read the terms carefully to avoid surprises.

Services Offered with Kotak Zero Balance Account

- Net Banking: A secure platform that allows users to transfer money, pay bills, and check account statements online.

- Mobile Banking: The Kotak app provides easy access to manage your account, perform UPI transactions, and get alerts on account activity.

- UPI Transactions: Seamlessly integrated with popular UPI apps, allowing fast and free fund transfers to other accounts.

Limitations of Kotak Zero Balance Account

- Transaction Limits: Certain accounts may impose restrictions on the number of monthly free transactions at ATMs or branches.

- ATM Withdrawal Restrictions: Free withdrawals may be capped, after which additional fees may apply.

Tips for Managing a Zero Balance Account Effectively

- Regular Transaction Usage: To keep your account active and avoid dormancy charges, ensure at least one transaction every few months.

- Tracking Digital Benefits: Stay updated on cashback offers, reward points, and discounts offered to maximize benefits from the account.

Minimum Balance Requirements in Kotak Mahindra Bank

- Minimum Balance: ₹0

- This account allows customers to operate without maintaining any minimum balance. It is ideal for students, freelancers, and individuals looking for basic banking services.

Regular Savings Account

- Minimum Balance: Varies depending on the location of the branch:

- Metro/Urban Areas: ₹10,000

- Semi-Urban Areas: ₹5,000

- Rural Areas: ₹2,000

- If the minimum balance is not maintained, penalty charges may apply.

Privy League Accounts (Premium Accounts)

- Minimum Balance: ₹50,000 to ₹1,00,000

- These accounts come with exclusive benefits and personalized banking services but require a higher minimum balance.

Conclusion

Kotak Bank’s zero-balance accounts are tailored for the modern customer who values flexibility, ease of use, and cost-effectiveness. The Kotak 811 Zero Balance Account, in particular, stands out as a digital-first option, perfect for anyone looking to avoid traditional banking hassles while enjoying premium benefits. Whether you’re a student, professional, or entrepreneur, this account fits the bill for all your banking needs.

read also: Gisele Bündchen Announces Pregnancy with Boyfriend Joaquim Valente: A New Chapter Begins

Pingback: How to Open an SBI Bank Account: Complete Guide 2024 - US TRENDZ